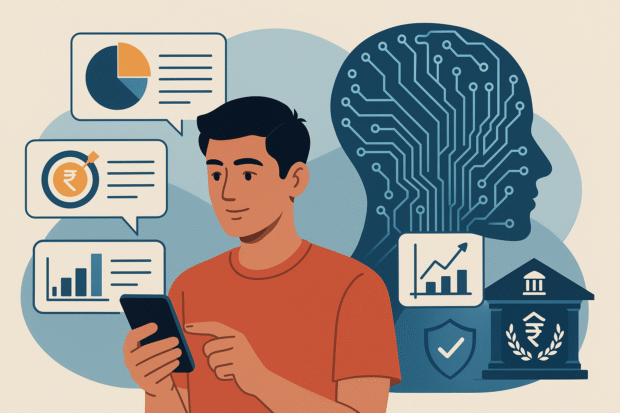

In 2025, Indian consumers are managing their money more efficiently than ever before—thanks to the growing integration of Artificial Intelligence (AI) in personal finance apps. From automating savings to predicting spending habits, AI has evolved beyond a backend tool. Today, it’s your financial coach, investment planner, and security watchdog, all rolled into one app.

Why Personal Finance Apps in India Are Booming

Until recently, managing money in India required spreadsheets, financial knowledge, or external advisors. That’s rapidly changing. Apps like CRED, Jupiter, Paytm Money, and Fi have made financial planning effortless, especially for India’s growing millennial and Gen Z populations.

The engine driving these innovations? Powerful AI algorithms that analyze spending patterns, income flows, and financial goals to deliver personalized financial insights.

Key AI-Driven Features in Indian Personal Finance Apps

1. Smart Spend Tracking

AI automatically categorizes expenses, identifies unusual transactions, and flags duplicate charges. It provides real-time nudges to curb overspending and helps users track where their money goes.

2. Automated Goal Setting

AI evaluates your income, lifestyle, and recurring bills to recommend realistic savings goals—whether for an emergency fund, home loan down payment, or travel plans.

3. Personalized Investment Recommendations

New to mutual funds, SIPs, or stock investing? AI demystifies investments by offering risk-adjusted plans tailored to your financial profile, age, and goals.

4. AI-Powered Credit Management

Apps simulate how your financial behavior—like repaying EMIs or using credit cards—affects your credit score. Features like “Credit Score Boosters” use AI to guide users toward better financial health.

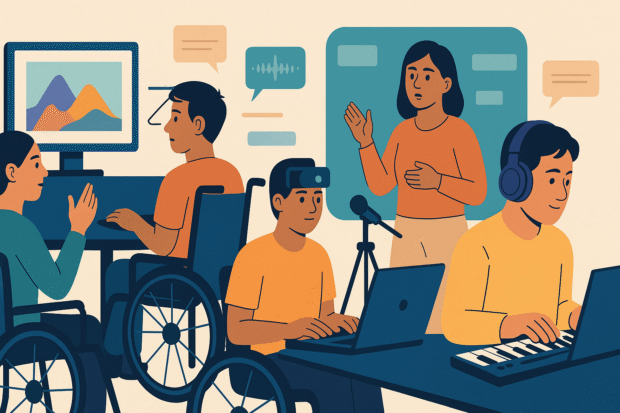

Making Finance Inclusive Through AI

One of the most powerful impacts of AI is improving financial literacy in India. With voice-based interfaces and regional language support, even users in Tier-2 and Tier-3 cities can access smart financial tools. Conversational AI helps first-time digital users understand and manage their finances with confidence.

Data Security and Trust: AI as a Digital Guardian

Security remains a top concern. AI plays a crucial role in detecting fraud through behavioral analytics and anomaly detection. For instance, if an account is accessed from an unfamiliar location or device, AI prompts the user for verification—adding an intelligent layer of protection.

What’s Next: The Future of AI in Indian Fintech

As India’s fintech ecosystem matures, AI will continue to reshape how people manage money. Look out for:

-

AI-integrated UPI payment reminders

-

Cross-platform financial health dashboards

-

Virtual AI-based financial advisors

With a digitally savvy, mobile-first generation at the forefront, India’s financial future is not only cashless but intelligent.

Final Thoughts

AI is transforming how Indians interact with money—making it smarter, more accessible, and safer. As personal finance apps continue to evolve, they’ll empower millions to take control of their financial well-being with ease and confidence.

Read More: Gadget Mania: Must-Have Tech Releases to Watch in 2025

Be the first to leave a comment